-medium.webp)

Table of Contents

Lenden means borrowing and lending, “give‑and‑take” of money, goods, or services to be repaid later. Under Nepal’s Muluki Civil Code 2074, such transactions—both formal and informal—must occur through a legally binding deed to ensure enforceability and transparency.

What Is a Deed and Why Does It Matter

A deed is a written document (including a cheque, bill, voucher, or receipt) that records the transaction. Conducting a Lenden without an executed deed is illegal, and courts will typically not enforce such agreements.

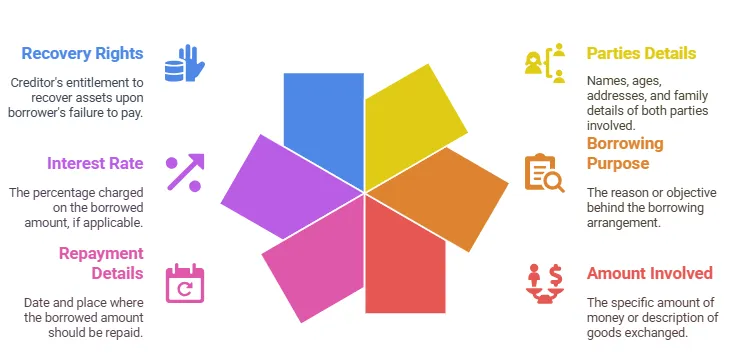

Essential Details in a Deed

Every legally valid deed must include:

Interest Rules, Clear Limits

The Code strictly governs interest:

If a deed specifies interest, it must not exceed 10% per annum

If a deed mentions interest but not the rate, 10% annual interest applies by default

If no interest is specified, interest cannot be charged

Compound interest is prohibited; any such excess must be refunded or adjusted

Repayment Procedures: Documentation Is Key

Upon repayment:

The creditor must sign and return or cancel the deed, indicating repayment

If the original deed is lost, a receipt of payment must be provided

For partial repayment, annotate the deed with receipts and the borrower's acknowledgment

Validity Period of a Deed

Personal household deeds are valid up to 10 years. If payment or renewal occurs within that time, the term resets for another decade. Court judgments during this term can enforce judgment-phase interest.

Unenforceable Deals—Special Cases

Certain scenarios void enforceability:

Transactions with minors or mentally incapable persons are not legally recognized

If a deed lacks the family head’s signature, the creditor must first prove the debtor’s independent property rights before recovery

However, courts may still enforce lending evidenced by bank statements, vouchers, or negotiable instruments

No Statute of Limitations for Serious Infractions

There is no time limit (statute of limitations) for cases involving:

Attempts to exploit minors or incapacitated persons

Charging compound interest

Charging interest exceeding 10% per annum

What’s New in 2025

Recent legal guidance emphasizes:

Strict penalty and refund for compound interest or excess interest

Stronger court powers to enforce banking records and digital evidence for proving oral loan transactions

Integration with consumer protection laws, ensuring fair lending practices and borrower rights

Why This Matters in Nepal Today

With digital lending (mobile wallets, microfinance, fintech) and informal village loans increasing, these rules:

Protect borrowers from exploitative interest rates

Encourage formal documentation for all loans

Provide legal clarity on repayment and default procedures

Deter fraudulent lending through strict enforcement

Building Trust Through Legal Clarity

Nepal’s Lenden Kanoon establishes a clear, fair, and enforceable framework for borrowing and lending. By mandating written deeds, capping interest, and outlining strict repayment protocols, the law balances borrower protection and creditor rights, promoting financial integrity across both formal and informal lending practices.

Disclaimer:

This article is intended solely for informational purposes and should not be interpreted as legal advice, advertisement, solicitation, or personal communication from the firm or its members. Neither the firm nor its members assume any responsibility for actions taken based on the information contained herein.