-medium.webp)

Table of Contents

Merger means two business entities join together to make a totally new business entity or to allow one business entity to survive absorbing the other business entity. In a merger one of the two existing companies' identities is merged into another existing company or one or more existing companies may form a new company and merge their identities into one by transferring to the new company. The shareholders of the company whose identity has been merged are then issued shares in exchange for the shares held by the shareholders of the merging companies.

The merger proposal along with the scheme of arrangement requires approval of BOD, approval of shareholders meeting (General meeting) through the special resolution, and approval from OCR and respective regulatory institutions.

An acquisition occurs when one company buys all of another company’s shares. The terms acquisition and takeover have almost the same meaning. BAFIA has defined acquisition as the act of acquisition by a bank or financial institution to another bank or financial institution having settled the entire assets and potential liabilities by winding up the legal capacity of such bank or financial institution.

Statutory Provision

- Company Act, 2063

- Merger Bylaws, 2068

- Acquisition Bylaws, 2068

- Merger and Acquisition Bylaws, 2073

Types of Mergers and Acquisitions

Mergers

- Horizontal Merger: Horizontal mergers involve a merger of companies from the same industry and market segment.

- Vertical Merger: Vertical mergers occur when companies at different stages of the production or distribution chain combine.

- Conglomerate Merger: Conglomerate mergers involve companies from unrelated industries.

Acquisitions

- Asset Acquisition: The acquiring company buys specific assets and liabilities from the target company.

- Stock Acquisition: The acquiring company buys shares or stock in the target company, gaining ownership of the entire business.

Procedure for the Merger of Public Companies.

Step 1: Adoption of Special Resolution

The acquiring company buys shares or stock in the target company, gaining ownership of the entire business. Adopting a Special Resolution is a critical step in the merger process of public companies in Nepal. It requires approval by at least 75% of shareholders present at the general meeting. This resolution ensures shareholder agreement on the merger terms, aligning with legal requirements under the Company Act 2063.

Step 2: Submit an Application to the OCR

First of all, the application for the merger of a public company should be submitted to the Office of Company Registrar along with all related documents, including a board resolution for the approval of the merger, audited financial statements of the companies, a copy of the details of merging companies, and a merger agreement on terms and conditions. The application shall be made in compliance with the legal provisions to ensure transparency and also to safeguard the interest of the shareholders. The corporation must submit an application to the OCR for merger approval within 30 days of passing the special resolution.

Step 3: Review and Evaluation of Application

Review and evaluation of the application by the regulatory authorities are one of the major steps involved in the merger of a public company. The Office of the Company Registrar or the relevant body, after the submission of the application, reviews it for its legality and propriety. It checks the correctness of the documents submitted, whether the merger is within the ambit of corporate governance policies, and its impact on the stakeholders. Authorities may seek clarifications, request additional documentation, or consult other agencies. The review process ensures transparency, fairness, and adherence to public interest. Upon satisfactory evaluation, the application progresses toward final approval and implementation. After reviewing the matter, the OCR will decide in three months.

Step 4: Approval and Transfer of Assets and Liabilities

Approval and transfer of assets and liabilities are an important part of the merger process in a public company. After approval from regulatory authorities, a formal resolution is passed to authorize the transfer. This involves consolidating the assets, liabilities, rights, and obligations of the merging entities into the surviving or new company. Legal documentation, such as asset transfer agreements and liability assumptions, ensures a seamless transition. The process should be done within the legal framework, protecting the interests of stakeholders and contractual obligations. After the transfer, the operational integration completes the merger by setting a base for unified business operations under the new entity. All of the merging company's assets and liabilities move to the combined company if it is approved. A proportionate return from the merging firm and a valuation of their shares before the merger are the rights of shareholders who oppose the merger.

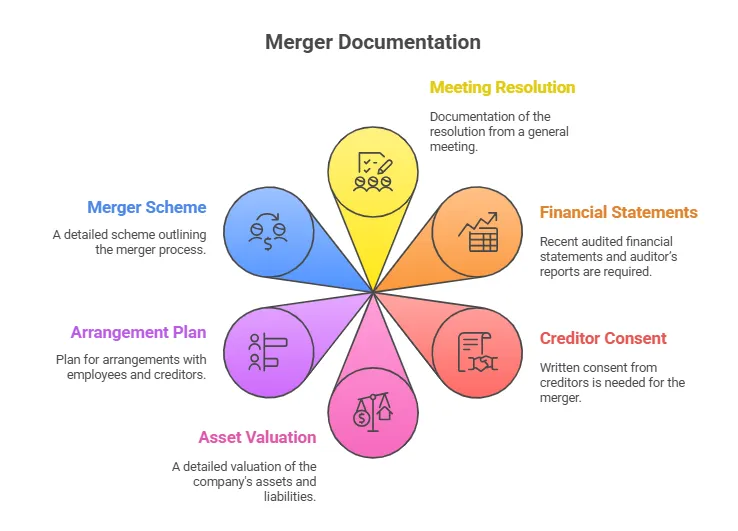

Documents Required for Merger

- For publicly traded firms, a copy of the general meeting decision; for privately held companies, a copy of the pertinent clauses from the articles of association, memorandum of association, or consensus agreement.

- The merging company's most recent financial sheet and auditor's report.

- Written approval from the merging and merged companies' creditors.

- Valuation of both immovable and moveable assets, as well as information on the merging company's assets and liabilities.

- Any choices made about merging and amalgamating companies' workers, creditors, and employees.

- The plan for the organization of the company merger.

Merger and Acquisition represents those strategic changes that allow companies to expand, restructure, or gain competitive advantages in the market. Merger refers to the combination of two or more firms into one new entity or the incorporation of one into another. While the acquisition is a purchase of another company's shares or assets with a change in the ownership structure.

The statutory provisions of Nepal, including the Company Act, 2063, and bylaws such as Merger Bylaws, 2068, govern the legal and procedural aspects of M&A, ensuring regulatory compliance. Types of mergers include horizontal, vertical, and conglomerate, while acquisitions can be asset or stock-based, offering varied approaches tailored to business needs.

From special resolutions down to regulatory approvals, the consummation of detailed procedures involved in the mergers of public companies underlines the importance of planning and transparency. Merger and acquisition deals with fostering innovation, efficiency, and growth as a pivotal tool for companies in dynamic market landscapes to pursue long-term success.

Frequently Asked Questions

In Nepal, a merger involves combining two companies into one, while an acquisition means one company buys another’s shares or assets. Both are regulated by Company Act 2063.

Nepal recognizes horizontal mergers, vertical mergers, and conglomerate mergers, classified based on industry type and position in the production/distribution chain.

Steps include passing a special resolution, applying to OCR, document review, regulatory approval, and transferring assets and liabilities. OCR decides within 3 months.

The Office of the Company Registrar (OCR) approves mergers and acquisitions, reviews applications, ensures legal compliance, and issues final merger approval.

Documents include special resolution, financial statements, asset/liability valuations, merger plan, creditor approval, and employee arrangements from merging firms.

Yes. A special resolution must be approved by at least 75% of shareholders present at the general meeting for public company mergers.

In an asset acquisition, a company buys specific assets and liabilities of another company, rather than its entire shareholding or identity.

Yes, private companies can merge under Company Act 2063 with proper documentation, board approval, and registration via OCR. They must follow simplified merger rules.

OCR must review and decide on the merger application within three months from the date of application submission after shareholder approval.

Shareholders of merging companies are issued new shares in the combined or surviving entity in exchange for their original shares, as part of the merger deal.

Disclaimer:

This article is intended solely for informational purposes and should not be interpreted as legal advice, advertisement, solicitation, or personal communication from the firm or its members. Neither the firm nor its members assume any responsibility for actions taken based on the information contained herein.