-medium.webp)

Table of Contents

An instrument of private transaction is an instrument prepared and passed for mutual trust when dealing with anything or property between an individual or an institution or between a natural or legal person. Different types of Tamasuk. Sections 474 to 492 of the Muluki Civil Code 2074 deal with the transactions.

Tamsuk means an instrument prepared for the security of money and mutual trust during a cash transaction between two parties. When transactions are taking place in our daily lives, oral transactions are not considered legal evidence. The paper written in the trust of the borrower is called Kapali tamasuk, so if the interest is not paid, then the creditor can recover money from the debtor’s property or household.

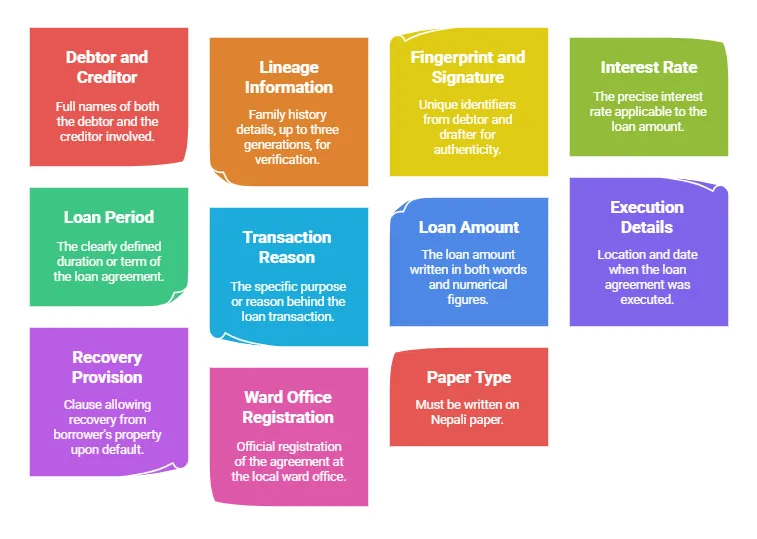

Things to keep in mind while writing a Kapali Tamasuk

- The name of the debtor and creditor shall be properly mentioned.

- Detail of three generations of debtor and creditor.

- Proper fingerprint and signature of the debtor and the drafter.

- Percentage of interest is to be mentioned.

- State the time period for lending the money.

- Tamasuk shall always be written on Nepali Paper.

- The words and number of borrowed moneys shall not differ.

- Reason for transaction.

- That the creditor may recover the amount involved in the transaction from the borrower's assets in the event of failure to repay such amount within the specified time or to fulfill the other conditions outlined in the deed.

- Place of the deed executed

- Date of the deed executed,

- Register the document in the ward office.

Types of Tamasuk

1. Kapali Tamasuk

Kapali tamasuk is a document that is made in the faith of the debtor without taking collateral. It is written in faith that the interest will be paid on this date without keeping any mortgage or property. If he/ she doesn’t pay the money then can be recovered from the property of the creditor. If interest is not written then the creditor can only charge up to 10% of interest.

2. Dristi Bandhak Tamasuk

Dristi Bandak Tamasuk refers to a written agreement where immovable property, such as land or a house, is mortgaged as collateral for a loan or financial transaction. The property of debtor is mortgaged for the protection of the property. This tamasuk is registered in Land Revenue Office. Immovable property, such as land or a house, is mortgaged as security for the loan.The lender does not take physical possession of the property but can claim ownership if the borrower defaults.

3. Bhog Bandhak Tamasuk

A document written to allow the moneylender to enjoy any property until the debtor pays the money back. After enjoying the property of the debtor the creditor is not authorized to charge the interest of the loan. If the creditor is not able to enjoy the property then the debtor has to pay 10% interest for the loan received. No more than 10% of the property can be enjoyed. Section 435 to 453 of the Muluki Civil Code mentions the mortgage of immovable property.

4. Lakhabandhak Tamasuk

A creditor who has mortgaged the movable and immovable property and has taken the amount mentioned or less than tamasuk and re-mortgaged the property. Retains ownership of the pledged item but loses custody during the loan term. Lender: Holds physical possession of the collateral as security for the loan.

Compound interest is not to be collected ;

If any creditor collects compound interest from a debtor, such interest shall be deducted from the principal and refunded if the principal has already been repaid.

Interest in excess of principal not to be collected:

the creditor shall not collect interest in excess of the principal.

Procedures to be fulfilled in paying and collecting principal and interest

- If the debtor fully repays the principal and interest, the creditor must sign and return the deed to the debtor by tearing it out or indicating repayment on the reverse side.

- If the deed is not found when repaying the principal and interest the creditor will provide the debtor with a receipt indicating the amount received on the specified date.

- When repaying a portion of the principal and interest, the creditor must indicate the amount received from the debtor on the reverse side of the deed. If the deed is not immediately available, the creditor must obtain the debtor's signature and issue a separate receipt for the amount owed.

Period of a deed executed in household:

The period of a deed executed in a household shall not exceed ten years. If a debtor repays or extends the term of a deed within ten years, another ten years will be added from the date of repayment or extension, as applicable.

If the court passes a judgment on a lawsuit, if any, made within the period then the creditor is entitled to recover interest as well, the creditor shall be entitled to the interest as of the date of recovery according to the judgment.

Tamasuk is an essential tool in sustaining trust and legitimacy in Nepal financial transactions. Tamasuk merges informal practices with legal frameworks to provide a clear understanding between parties involved and to be answerable. Some of the different forms of Tamasuk include Kapali Tamasuk, Dristi Bandhak Tamasuk, Bhog Bandhak Tamasuk, and Lakhabandhak Tamasuk. These are regulated by sections 474 to 492 of the Muluki Civil Code 2074. The agreements must be documented, including information about parties, loan terms, and collateral and sometimes even registered. To avoid compound interest and heavy charges, the law has put some restrictions on it. Tamasuk supports borrowing and lending easily but demands careful adherence to legal and ethical standards. The fact that this facility of credit availability also reinforces mutual trust has given it its persistent relevance in Nepal's socio-economic environment.

Tamasuk Lawyer in Nepal

At Alpine Law Associates, we understand that financial transactions based on mutual trust require more than just a handshake—they require legally binding documentation to protect both parties. That’s where Tamasuk comes in. As a full-service, legally registered law firm in Nepal, we specialize in preparing, validating, and legally enforcing various forms of Tamasuk, including Kapali Tamasuk, Dristi Bandhak, Bhog Bandhak, and Lakhabandhak. Whether you're a lender seeking legal protection for your loan or a borrower wanting to understand your rights and obligations, our experienced legal team is here to guide you every step of the way. We help draft watertight documents, register them in ward or land revenue offices where necessary, and represent you in court should any disputes arise. With our in-depth knowledge of Sections 474 to 492 of the Muluki Civil Code 2074 and years of practical experience, Alpine Law Associates ensures your financial agreements are both legally secure and ethically sound. Let us take the burden off your shoulders—because every agreement deserves clarity, legality, and protection.

Conclusion

Tamasuk remains a critical legal instrument in Nepal’s financial and social structure, bridging traditional trust-based transactions with formal legal enforceability. Whether it’s a simple Kapali Tamasuk written on faith or a Dristi Bandhak Tamasuk secured with immovable property, the law ensures that these agreements are honored with fairness and accountability. However, preparing a valid Tamasuk requires careful attention to detail—everything from fingerprints and generation details to interest clauses and documentation standards. If done improperly, you risk unenforceable claims or even legal complications. At Alpine Law Associates, we help ensure your Tamasuk agreements are legally sound and protect your financial interests. Whether you're dealing with personal lending, property mortgage, or dispute resolution, our lawyers are ready to support you with reliable, experienced counsel. Contact us today and secure your transactions with the legal protection they deserve.

Frequently Asked Questions

Tamasuk is a legally binding financial agreement used in Nepal for lending and borrowing money, recognized under the Muluki Civil Code 2074.

Yes, Kapali Tamasuk is valid even without collateral. It is based on mutual trust and must be properly documented for legal enforceability.

Tamasuk must be registered at the ward office or Land Revenue Office, depending on whether it involves movable or immovable property.

The four main types are Kapali Tamasuk, Dristi Bandhak Tamasuk, Bhog Bandhak Tamasuk, and Lakhabandhak Tamasuk.

No, Nepalese law prohibits charging compound interest on Tamasuk. If collected, it must be refunded or adjusted.

No, oral financial transactions are not legally valid. A written Tamasuk is required to enforce any loan or credit agreement.

It must include debtor and creditor names, three-generation details, fingerprint, interest rate, repayment period, and transaction reason.

A Tamasuk is valid for 10 years. If renewed or partially repaid within this period, another 10 years is added from the new date.

If unpaid, the creditor can file a case in court and recover the money by attaching the borrower’s property or assets.

Legal firms like Alpine Law Associates can professionally draft, verify, and register your Tamasuk to ensure legal protection.

Disclaimer:

This article is intended solely for informational purposes and should not be interpreted as legal advice, advertisement, solicitation, or personal communication from the firm or its members. Neither the firm nor its members assume any responsibility for actions taken based on the information contained herein.